The second tranche of the Bharat Bond ETF (exchange traded fund), managed by Edelweiss mutual fund, will be up for subscription from July 14. Just like the first tranche of December 2019, the second offer will come in two variants: a 10-year ETF that will mature in April 2030 and a five-year product that will mature in 2025.

What is this bond about?

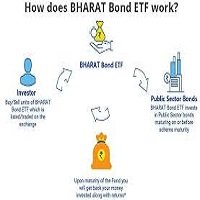

The Bharat Bond ETF is India’s first to corporate debt ETF. Companies approach the firm managing the bond ETF with their borrowing requirements. The bond ETF raises funds from investors and hands them over to the underlying companies for a fixed tenure. Once the tenure is over, these companies return the amounts back to the ETF, which then passes it on to the investors. The units of both the ETFs will be listed on the stock exchanges where they can be traded. The units of the first tranche will continue to be available for trading in the NSE.

You can also buy and sell units from the fund house directly, but you need to transact for units worth Rs 25 crore. A fund-of-funds is also made available to those who do not have demat accounts.

What works

The structure of this ETF is its main selling point. The Bharat Bond ETF will continue to be a channel for a large cluster of state-owned firms that need to borrow. This is aimed at improving the liquidity of the underlying securities, although these are early days and any positive results may still come quite later. The corporate bond market, where non-convertible debentures and other debt instruments are issued by companies, remains fairly illiquid. That is, there aren’t enough buyers and sellers of these securities.

Now, corporates will collectively issue fresh securities to the bond ETF. The ETF also picks up already-issued and existing securities of the same companies with the same maturity and converts them into an investment basket. As the ETF units are bought and sold, the underlying securities too get traded (through the market makers that the fund house appoints) and thereby become more liquid. If the demand for the Bharat Bond ETF picks up – there are plans to come out with repeated tranches twice every year – more debt securities of these state-owned firms would become liquid.

This promises to improve liquidity into an otherwise illiquid bond market.The ETF does not carry credit risk. It invests in only AAA-rated State-owned firms. On account of the defined maturity, investors get some sort of return predictability. The indicative yield of the Bharat Bond ETF – April 2025 version – is 5.71 percent. A small caveat: this is the yield you will get if you invest in the benchmark index of the Bharat Bond ETF April 2025. Similarly, the Bond ETF-April 2031 comes with an indicative yield of 6.82 percent. If the ETFs are to earn close to these returns, then the funds need to deployed soon.

What doesn’t work

The speed with which the ETF deploys money in the market will ascertain the fund’s yield-to-maturity and how much return you will make. There was a slight delay in deploying the funds after the first tranche, which affected its yield a bit. The sooner the funds are deployed, the more predictable the returns can get.

The bond ETF also needs to be agile if an underlying company defaults on its interest or principal payments, or even if its credit rating falls. If a company gets downgraded, but still remains an investment-grade paper, the NSE Bharat Bond indices will remove the security at the subsequent rebalancing date. The ETF will also simultaneously exit the security. But between these downgrade and the exit, the security’s price can drastically go down and impact the scheme’s net asset value.

As improbable as this might seem, if the underlying security defaults, then there’s a bigger problem. An industry official familiar with the composition of the Bharat Bond ETFs says that the fund will remove a defaulting within five days, but at a price that is found reasonable. This can cause a setback to the fund, though a state-owned AAA-rated defaulting is a rare occurrence. Bharat Bond ETF has a provision for a segregated portfolio, like most other open-ended debt funds.

Should you invest?

The tracking error is a key element to keep tabs on. How quickly the Bharat Bond ETF deploys its inflows after the NFO will ascertain the scheme’s tracking error. The fund house had to suffer a bit of delay in the first tranche. As the NFO at the time closed towards the end of 2019, some underlying companies chose to wait for the new year to get clarity on their borrowing requirements. The revision in stamp duty that took place early January 2020 was another speed-breaker; some state-owned companies waited further to get clarity. As per NSE’s website, the yield-to-maturity (YTM) of the Nifty BHARAT Bond Index – April 2030 was 6.75% as on July 2. Bharat Bond ETF-April 2030’s YTM was 6.69%. The shorter this gap, the better it is for the ETF.

The Bharat Bond ETF is a good investment if you can hold on to your units till maturity. That way, returns are a bit predictable. If you buy at market prices or sell before maturity, you would need to re-calculate the yield that you are most likely to earn. For those in the higher slabs, post-tax returns would be better than those on competing instruments. The new tranche is slightly better than the first tranche on account of the slightly higher YTM of the benchmark indices. Remember, the Bharat Bond ETF does not give monthly income. The new fund offer (NFO) will remain open till July 17, after which its units will be available on the stock exchanges.